Welcome to the IDB (I Deserve Better). Join the 1,000+ commerce graduates who are discovering smarter career paths, building in-demand skills.

For the past two years, I have been mentoring commerce graduates and helping them navigate their career paths. As a B.Com (Hons) graduate myself, I understand how confusing it can be to decide what skills to learn and where to focus your efforts. Everyone needs a guide or at least someone to show them the best options. That’s exactly what IDB does—it provides career clarity, helps you develop in-demand skills, and prepares you for high-paying jobs. Because, let’s face it, who doesn’t love earning well?

My career journey –

2014-2017 – B.com Hons (Delhi University)

2017-2019 – EY (Audit Associate)

2019-2021 – MBA, IIM and CFA L2

2021-2022 – Deloitte (Consultant -Valuations)

2022-present – Investment Banking Analyst at Bulge Bracket IB firm!

Last week, while I was teaching a new batch of financial modeling, I circulated a form in advance to understand which career-related topics they wanted me to cover. The top three questions were:

- How can a commerce graduate make a lot of money?

- Which degree or MBA college will yield the highest CTC?

- What should I learn to earn a lot of money?

So, I decided to write a post about money, how you should view money, and which skills you need to earn a lot of it.

In the same class, there was a student who had cleared CFA Level 2 and graduated with a B.Com (Hons.). Despite being a college topper and putting in all that hard work, he ended up with a mere 5 LPA job. He even remarked that he didn’t want to complete the CFA program because he felt it was useless. Unfortunately, I’ve seen many people believe that simply earning a degree, completing a professional course, or doing an MBA will lead to high-paying opportunities. It never does.

There will be countless people, companies, and colleges promising that if you enroll in their program, you’ll be all set and get placed at X CTC, among other lofty claims. Most of these pitches focus on easy paths to making money, which simply don’t exist.

So, amid the sea of bad advice, here’s my attempt to offer some genuine insight—my honest advice to anyone who wants to make a lot of money.

Note: If some of this feels harsh, tough, or painful, it’s because it is.

The Only Way to Make a Lot of Money Is to Create a Lot of Value

Here’s a harsh truth: No one hands out money. No one will pay you just because they like you, think you’re cool, or because you graduated from IIT/IIM, earned a CFA, or came from an MBB (McKinsey, Bain, BCG) background. That’s not how the world works.

Money earned is a direct by-product of the value you create. If your target salary is 15 LPA, you need to generate at least four times that amount (around 60 Lakhs) in revenue for the business. Out of that 60 Lakhs in value, you get paid 15 Lakhs.

Create value, receive value. If money is the goal, value must be the focus.

This isn’t just some vague idea: the only way to get rich is by creating an enormous amount of value for others—and capturing a small portion of that value along the way.

The only way to create value is by doing the thing.

Time is your most valuable financial asset at the start of your career.

When you’re young, you typically have no specialized skills, networks, or money. Time is all you really have to give. But many students use that precious time pursuing degrees and certifications instead of building actual skills.

Take the student who cleared CFA Level 2 with a top college B.Com. Yes, you graduated from a reputed institution and completed one of the most in-demand finance certifications. But can you immediately add concrete value to a company’s business the day you’re hired?

If not, you’ll start at 5 LPA and then progress by acquiring and refining skills that create more value—thereby earning you more money. It’s a never-ending process.

Always Calculate Your Per-Hour Rate

If you earn 5 LPA, your effective hourly rate is 500,000 ÷ (240 * 8), assuming 104 weekends and 21 paid leaves. That comes out to roughly Rs. 260 per hour. Meanwhile, a McDonald’s worker in the US gets paid around $13 per hour. If we account for a purchase power parity multiple of 4, and $1 = Rs. 86, that worker would earn roughly Rs. 300 per hour.

We all start small. I started with an hourly rate of Rs. 80 and reached Rs. 2,500 in about seven years. Isn’t that a multibagger return? But it took consistent learning, upskilling, and reading challenging materials to get there.

India is fundamentally a cheap labor market, so you need to stand out by developing high-paying skills to reach the level someone in a developed country might earn with a basic job. Therefore, when you’re young, aim for skills that will increase your hourly rate over the long term. That’s how you boost your income.

You Never Truly “Make It”

People often think “making it” is an end state—especially in our society. Just pass the 12th with above 95%, and you’re set. Just do B.Com, CA, or MBA and you’re set. Just do this course, and you’ll be good to go forever.

Wrong. Every single day, you have to fight to earn your seat at the table. Every single day, you’re striving to create the value that will ultimately pay you.

This is universally true: if Apple stops making new iPhones, within a few years they will no longer be a successful company.

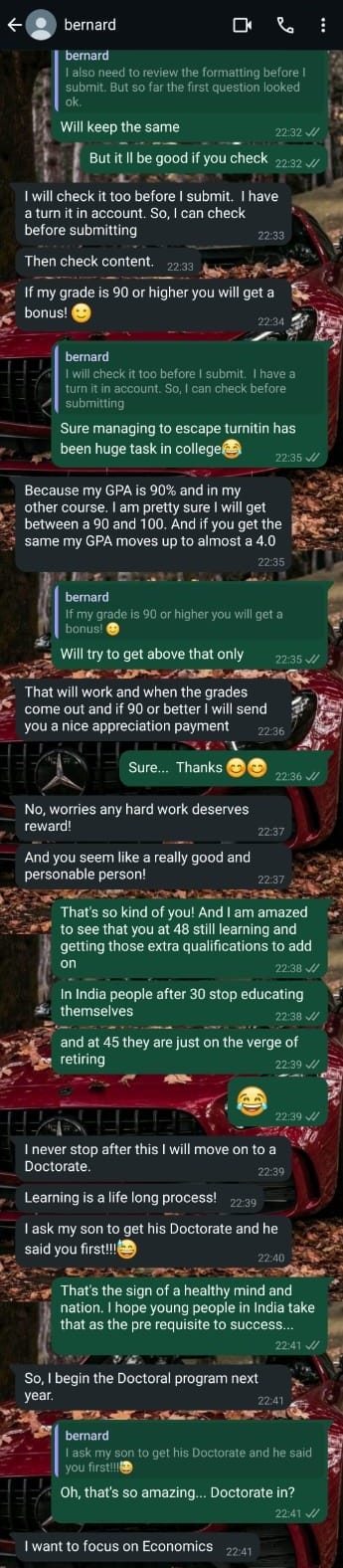

In 2021, when I learned advanced financial modelling, I wanted to test my skills for actual income. I started freelancing and met a professional from China who was an SVP at a company and was simultaneously pursuing his second master’s degree. He wanted help with some modelling tasks for his thesis. I wondered why someone would pursue a second master’s degree at age 48 when he was already an SVP. He told me he plans to go for a doctorate next. While simply pursuing degrees might not guarantee skills, his decision to keep studying at that age and seniority level showed the kind of courage and continuous learning mindset everyone should have.

Here is the story –

The reality is the more success you have, the more intense the fight becomes: you have more to lose, more responsibilities, more people depending on you, and higher expectations. If you enjoy this process, build good habits and consistent learning practices—you’ll fall in love with learning.

Top skills to learn for high paying jobs entry level jobs

Finance

· Financial Modelling

· Valuations

· Financial Analyst

· Forensic Accounting

Marketin

· Performance Marketing

· Whatsapp Marketing

· Customer retention management

Analytics

· PowerBI

· SQL

· Tableau

If you gain proficiency in any of the above, you’re likely to land in the top 1% of salaries for commerce graduates.

In the long run, climbing the career ladder will require you to develop more technical skills. Nearly 50% of the finance job postings in the U.S. and U.K. now list requirements for Python, SQL, Power BI, or other technical software. If you don’t stay current with these evolving technologies, your chances of landing unique, high-paying opportunities will be slim.

Consider this: perhaps around one million people worldwide have financial modeling skills. Of those, maybe 100,000 possess financial modeling, valuation, and solid business analysis skills. Now think about how many have all those skills plus Python proficiency—perhaps only 10,000.

The more you diversify and enhance your skill set, the more specialized you become, and the better your salary prospects will be.

Closing Thoughts

There’s an old saying I love:

Every morning in the savannah, the gazelle wakes up and knows it must outrun the lion or be killed. The lion wakes up and knows it must outrun the gazelle or starve. Whether you’re the gazelle or the lion, when you wake up in the morning, you’d better start running.

You have to earn your place every single day. That’s why building skills is crucial, but building high-income habits matters even more. Keep reading about new technologies and business models, and keep learning and upgrading your skill set continuously.

One of the most important habits is figuring it out.

Build a reputation for figuring things out. You’ll get a lot of tasks you have no idea how to approach. There’s nothing more valuable than someone who can just make it happen: do the research, ask the right questions, and get the job done. People will literally fight to hire you if you can do that.

Once during my MBA, a professor asked me, “What’s your biggest achievement so far?”

I was utterly confused. I said cracking CAT and getting into a decent B-school. He replied that while it might be your biggest achievement today, don’t let that be your only answer five years down the line. Since then, I always kept myself reminding that.

Hence, keep learning, keep growing, and keep upgrading yourself.